We’ve created this guide, including the FAQs below, to help you understand the Alabama health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

An ACA Marketplace (exchange) plan – or Obamacare – is a good option for anyone who needs to buy their own individual or family health coverage, including people who aren’t eligible for Medicaid, Medicare, or an employer-sponsored health plan.

Alabama uses the federally run Marketplace, so you can enroll at HealthCare.gov . Three private health insurance companies offer plans through the Marketplace in Alabama, and all three will continue to offer coverage in 2025. Two of the three carriers have proposed an average rate decrease for 2025 1 (see rate change details below)

Nearly all Alabama Marketplace enrollees qualify for financial assistance with the cost of their coverage. 2

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Alabama.

Learn about Alabama's Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Alabama as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Alabama.

To enroll in private health coverage through the Marketplace in Alabama (HealthCare.gov), you must: 3

So most people are eligible to enroll in Marketplace coverage. But qualifying for financial assistance (premium subsidies and cost-sharing reductions) depends on your income and also has some additional parameters. To qualify for financial assistance with your Marketplace plan you must:

You can sign up for an ACA-compliant individual or family health plan in Alabama between November 1 and January 15 during the annual open enrollment period .

To have your coverage take effect on January 1, you need to complete your enrollment by December 15. If you apply between December 16 and January 15, your coverage will take effect on February 1. 8

Outside of the open enrollment window, you may be eligible to enroll or make a plan change if you experience a qualifying life event, such as giving birth or losing other health coverage. And some people can enroll year-round even without a specific qualifying event.

Enrollment in Alabama Medicaid and ALL Kids (CHIP) is available year-round, so if you’re eligible for either program, you can enroll anytime.

To enroll in an ACA Marketplace (exchange) plan in Alabama, you can:

You can also call HealthCare.gov’s contact center by dialing 1-800-318-2596 (TTY: 1-855-889-4325). The call center is available 24 hours a day, seven days a week, except for holidays.

You may find affordable health insurance coverage in Alabama by enrolling through HealthCare.gov. This is especially true if you qualify for premium tax credits (subsidies), and most Alabama enrollees are subsidy-eligible. 11

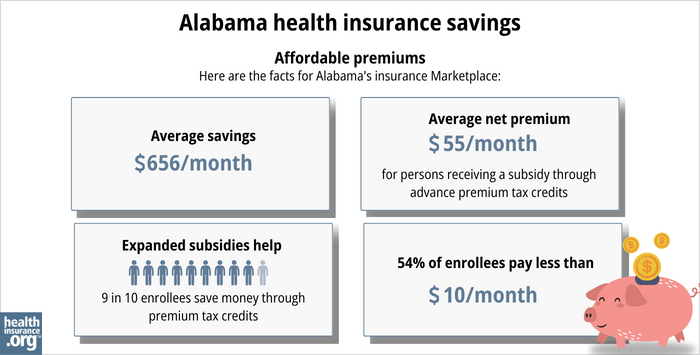

As of early 2024, 98% of Alabama Marketplace enrollees were receiving premium subsidies. 11 These premium subsidies saved enrollees an average of about $657/month. After subsidies were applied, the average enrollee’s monthly cost was about $64/month. 11

(The numbers above are based on effectuated enrollment in early 2024. The chart below is different because it measures some different metrics and also uses data from all enrollments submitted during the open enrollment period for 2024 coverage.)

If your household income isn’t more than 250% of the federal poverty level, you may also qualify for cost-sharing reductions (CSR). These subsidies can make your deductible and other out-of-pocket expenses smaller than they would otherwise be, as long as you select a Silver-level plan. As of 2024, more than two-thirds of the people with Marketplace coverage in Alabama were receiving CSR benefits. 11

If you’re eligible for APTC and CSR benefits you can utilize both as long as you select a Silver-level plan (APTC can be used with plans at any metal level, but CSR benefits are only available on Silver plans).

Depending on your income and circumstances, you may find that you’re eligible for free or low cost health coverage through Alabama Medicaid or ALL Kids (CHIP). Check to see if you meet the criteria for these programs in Alabama.

Three private insurers offer coverage through the Alabama Marketplace. 13 All three have filed rates and plans for 2025 Alabama Marketplace coverage, and two of the three have proposed an average rate reduction. 14

The following average rate changes have been proposed for 2025 by Alabama’s individual/family health insurers, including two overall rate reductions: 1

Source: RateReview.HeathCare.gov 15 and Alabama Department of Insurance 16

Keep in mind that these average rate changes are for full-price (unsubsidized) plans. However, very few enrollees pay full price. Nearly all (98%) of Alabama’s Marketplace enrollees were receiving premium tax credits in 2024 that covered some or all of their monthly premium costs. 11

These subsidies are adjusted to match changes in the benchmark plan (the second-lowest-cost Silver plan) in each area. And as a result of the American Rescue Plan and the Inflation Reduction Act, the subsidies are larger and more widely available than they used to be. This will continue to be the case through 2025 17 (it could be extended past that, but only with an act of Congress).

But if the benchmark (second-lowest-cost Silver) plan premium decreases from one year to the next, premium subsidies in that area will also decrease. So it’s important to comparison shop during open enrollment, even if your plan’s pre-subsidy premium is going down.

For perspective, here’s a summary of how average unsubsidized premiums have changed over time in Alabama’s individual/family health insurance market:

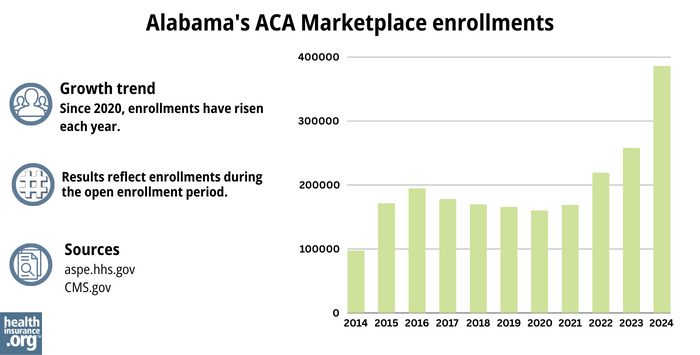

During the open enrollment period for 2024 coverage, 386,195 people enrolled in private plans through Alabama’s health insurance Marketplace. 28

This was by far a record high, dwarfing enrollment in previous years (see chart below). Before 2024, the highest enrollment had come in 2023, when 258,327 people enrolled through Alabama’s Marketplace. 29

The sharp increase in enrollment in recent years is due in large part to the subsidy enhancements created by the American Rescue Plan and Inflation Reduction Act, which have made coverage more affordable than it used to be.

The enrollment growth in 2024 was also partially driven by the “unwinding” of the pandemic-era Medicaid continuous coverage rule. Medicaid disenrollments resumed in the spring of 2023, and by April 2024, more than 93,000 Alabama residents had transitioned from Medicaid to a Marketplacen plan during the unwinding process. 30

Source: 2014, 31 2015, 32 2016, 33 2017, 34 2018, 35 2019, 36 2020, 37 2021, 38 2022, 39 2023, 40 2024 41

HealthCare.gov

The Marketplace in Alabama, where residents can enroll in individual/family health coverage and receive income-based subsidies. You can reach HealthCare.gov at 800-318-2596.

Alabama Department of Insurance

Licenses and regulates health insurance companies, agents, and brokers; can provide assistance to consumers who have questions or complaints about entities the Department regulates.

Alabama State Health Insurance Assistance Program

A local service that provides assistance and enrollment counseling for Medicare beneficiaries and their caregivers.

Alabama Medicaid Agency and ALL Kids (Alabama’s Children’s Health Insurance Program)

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.